FHA Mortgage with no Borrowing from the bank 2022 Recommendations

FHA fund features certain borrowing from the bank standards and advice you to definitely FHA lenders need realize if you find yourself operating and underwriting the borrowed funds application. Although the FHA credit conditions are rigid, you can buy an FHA financing and no credit rating. In reality, HUD prohibits loan providers out of decreasing a great borrower’s FHA loan application just as they use up all your a credit score.

Do i need to score a keen FHA Mortgage with no Borrowing? You can get an FHA loan and no credit given that FHA guidance require lenders to make use of most other means to dictate good borrower’s capacity to repay the loan if there is no credit rating available from traditional credit agencies.

Important FHA Credit Criteria

- Minimal Credit history of 580 = Advance payment away from step 3.5%

- Credit score out of five hundred-579 = Down-payment away from ten%

If you aren’t sure what your credit score are, the other of our FHA loan providers normally talk about the options and you may option way to be considered. You may also understand our very own post on the fresh new F HA borrowing from the bank standards for more information. When you have zero borrowing anyway, keep reading less than.

Being qualified having an FHA Loan no Credit

If there is zero credit score available otherwise credit ratings regarding the three credit agencies, HUD requires FHA loan providers to locate other ways to determine the credit history. Your bank will inquire about documentation from other qualities and you can financial institutions who typically do not declaration your own commission record with the borrowing from the bank providers. These are merely some examples regarding whatever you decide and feel expected to include:

- Page from the property owner recording new promptly lease repayments

- Percentage record for your electric organizations (gasoline, electric, liquid, etc)

- Fee background for your cellular telephone otherwise websites vendor

- Commission record for your homeowner’s insurance policies

- Fee record for the assets taxes

- Payment record for your car insurance

These are the priples out-of exactly what the FHA bank would query observe and this refers to also referred to as non-traditional borrowing. They could perhaps not require most of these nevertheless the way more you might provide, the higher it might be to suit your app opinion.

Once these records is actually gotten by your bank, the loan software goes as a consequence of a handbook underwriting process. In most instances, the loan apps try reviewed from the an automatic program one activities an approval, denial otherwise opinion of the a keen underwriter.

Tips guide underwriting occurs when the fresh compensating circumstances and extra records your considering is analyzed to determine if you qualify.

Excite be ready along with your most recent credit ratings for the discussion that have that installment loans for bad credit in Hudson South Dakota loan manager. Checking the results here will not feeling the fico scores in any way.

The deposit element step 3.5% may be the same even although you don’t possess an excellent filed credit history. In fact, it’s best to own zero borrowing and you can glance at the manual underwriting process than it is having poor credit.

Files Had a need to Be eligible for an enthusiastic FHA Mortgage with no Borrowing

When obtaining an FHA mortgage with no borrowing from the bank, you still have to deliver the needed records when it comes down to FHA loan.

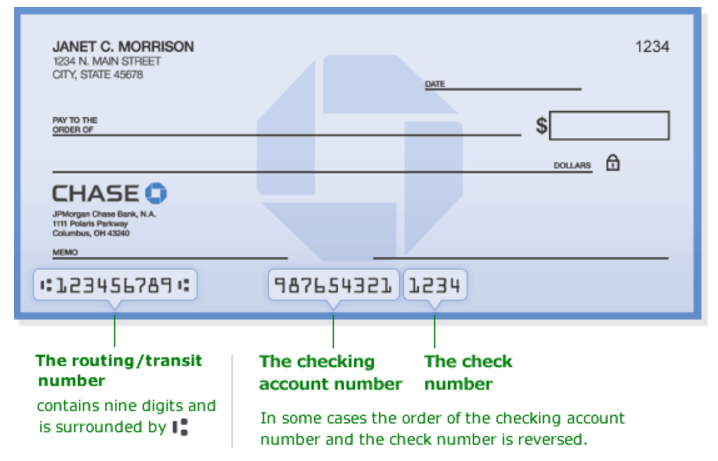

- Personal safety number otherwise credit

Understand our post on every FHA loan standards in order to see what otherwise you should know on the being qualified.

The thing that makes Your credit score Essential for a keen FHA Financing? The financing rating is the key factor loan providers glance at whenever deciding the danger regarding the mortgage. As credit rating worsens, loan providers turn to offset one to risk from the enhancing the interest rate or asking for a higher down-payment. Thus, a reduced credit history might charge you thousands of dollars from inside the more notice costs along side longevity of your loan.

Were there zero credit score assessment FHA finance? FHA lenders are required to look at your credit for the credit revealing organizations otherwise by hand review your credit report when credit ratings is unavailable. Loan providers usually to go through that it credit assessment procedure each FHA financing with no conditions.

What’s the low rating the brand new FHA encourage? A reduced credit rating deductible getting an enthusiastic FHA financing for each and every HUD direction try five hundred.

Where must i come across a lender to possess an FHA Mortgage having zero borrowing? Not totally all loan providers are identical with regards to FHA funds. Yet not, extremely should have the ability and you may readiness so you’re able to yourself underwrite the financial app unless you have a timeless credit history.

Associated FHA Info and you will Stuff

How to get Borrowing Fast This post details how to build your credit rapidly once you come into the middle of looking for a home and need so you can qualify for the financial quickly.

What exactly is Borrowing Karma? Have you ever questioned what Borrowing Karma is and you can whether or not using it is really worth the issues? Discover just what the individuals Borrowing from the bank Karma adverts are only concerned with contained in this article.

Trying to find an enthusiastic FHA financing with less than perfect credit The article you merely realize discussed how-to qualify for an enthusiastic FHA mortgage with no credit. Yet not, this short article reveal the way to get an enthusiastic FHA loan that have poor credit.

How to get pre-recognized to have an enthusiastic FHA loan If you need a great pre-approval page to begin with in search of a home, this short article show everything you need to find out about protecting one to pre-recognition.

Getting a keen FHA financing and no with your own money finance We quite often score expected whether or not you can buy a keen FHA loan that have zero down. Even when FHA recommendations require an advance payment, you can get the loan without the up front money.

FHA deposit direction There are many FHA downpayment recommendations apps around inside the the condition. Understand those are available to you and tips make them.

FHA mortgage as opposed to a 2 season performs history People find it impossible to score an FHA financing in the place of a 2 12 months functions background. Yet not, you can purchase approved even though you haven’t been doing work for the past couple of years constantly.

Được đóng lại.