Can you use a home Security Mortgage for Things?

Maybe you have wondered how to pay for high costs for example a home remodel or child’s degree? Lots of people explore a property guarantee financing to pay for such will cost you in lieu of depleting their offers.

For many who individual a house, you can qualify for a house guarantee loan. These types of fund makes it possible to money stuff you is almost certainly not able to pick comfortably with your monthly income. But are indeed there one limitations throughout these financing? Is there all you cannot finance with this particular money? Keep reading understand just what a home security financing are and what you could make use of it getting.

What is actually Household Collateral?

![]()

Domestic security is the difference in the new appraised property value your own house and just how far you continue to owe on the financial and you will another possessions liens. Instance, say your home appraises having $2 hundred,100000 and you have $120,000 left to pay on your own number one mortgage. Your own left family security could be $80,000. You need to use property equity mortgage so you can borrow on a part of the fresh collateral you have of your property.

What is a home Collateral Loan?

Extent it’s also possible to acquire hinges on the equity additionally the residence’s market value. Make use of your property once the collateral toward financing, incase you’ve got a primary mortgage toward house, it’s under compared to that first mortgage. For this reason house security finance are called next mortgages.

The loan can get a set title and you may rate of interest, just like your first mortgage. If you get a home security mortgage, you’ll get your money in one lump sum payment in advance and you may always rating a fixed rate about what your acquire.

By contrast, a home security personal line of credit (HELOC) enables you to mark at risk out-of borrowing as you want to buy, providing rotating the means to access dollars to own an appartment draw period. Your payment is then based on the amount of money you moved otherwise cutting-edge. With an excellent HELOC, you will likely rating a variable rate loans in Sanford that increases otherwise off with regards to the finest price.

How does a house Equity Financing Work?

To help you be considered people having a home collateral financing, extremely loan providers need an effective credit rating. They’re going to also consider the loan-to-worth (LTV) ratio, the overall quantity of mortgages or any other liens toward your residence split up by the its appraised worth. So it count will then be multiplied of the a hundred to get shown as the a share.

For example, state our very own $200K citizen that has $120K kept to blow on the domestic wanted a loan off $30K. The latest LTV proportion is: ($120K + $30K)/$200K = .75. So, the LTV would-be 75%. The better their LTV, the better their interest are.

It is important to observe that you will possibly not have the ability to use the full worth of your residence, based your own lender. You can examine that have any possible bank in advance of distribution your own app to see what limits they have positioned.

As with any financial, there can be settlement costs from the a home equity loan, even if they are usually lower than an initial mortgage. You begin to invest back a home guarantee loan immediately and you can have to pay it back completely by the end of financing identity.

As to the reasons Get a home Equity Mortgage?

You will find several advantages to opting for a property collateral financing alternatively of another variety of borrowing solution. A couple are usually given below.

- Low interest rates. The new costs discover for a house guarantee financing constantly slip below the individuals you are given into a personal loan or borrowing card.

- Larger sums. Extremely domestic security loans are having ample sums of cash so much more than a couple of hundred or even a couple of thousand dollars. It may be tough to safer like loans through-other means.

What are Home Guarantee Funds Useful for?

Officially, you should use a property guarantee financing to cover something. However, many people utilize them for larger expenses. Listed below are some of the very most popular ways to use home collateral finance.

- Building work a house. Payments to help you contractors as well as for product make sense rapidly.

- Medical costs. A major surgery or enough time treatment can result in higher scientific expense.

- Studies. Fund can help purchase individual additional schooling otherwise college or university.

Discover, although not, some instances where a house equity financing might not be this new sple? Performing a business. That is a risky proposition. If you use your house security to begin with a corporate, as well as the organization fails, you may find you’re unable to result in the repayments on your own financing. Since you made use of your residence as the guarantee, this may lead to a bad-instance circumstance away from dropping your property, along with your business.

In addition, you will most likely not want a property equity loan for individuals who never plan to fool around with a large amount of currency at once. Which have a home collateral loan, you will get a lump sum payment and ought to repay it in installment payments every month. Otherwise you prefer a huge share at the same time, you are best off considering a good HELOC or some other mortgage that requires that pay just with the part of the mortgage you put.

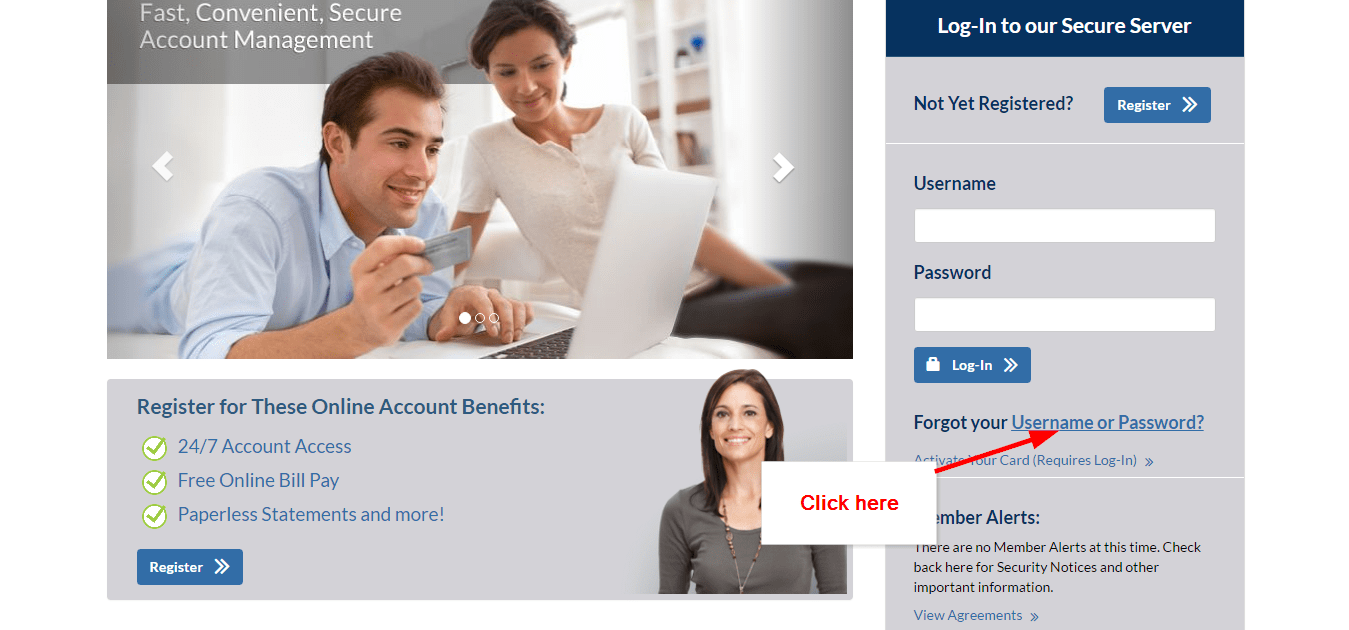

Are you currently looking for a property collateral financing? We offer aggressive costs for our players. Please remember and determine our WalletWorks webpage to get more currency administration resources.

Được đóng lại.