Could you Rating a great Virtual assistant Mortgage having Less than perfect credit?

Thinking of purchasing a home that have an excellent Va financing however, alarmed regarding your credit history? When you’re a good credit score assists keep the ideal pricing, will still be you’ll be able to to acquire a Va loan even after crappy borrowing.

You might be dreaming of buying a home having fun with a great Virtual assistant financing, however, you are worried that credit score will substitute this new method. It’s reality one to that have good credit setting you’re getting the best rates to the a mortgage, whatever the type of home loan you’re getting. However, you can score Va loan with bad credit.

The new Agencies out of Pros Activities is not the bank to have an excellent Virtual assistant home mortgage however, backs, or guarantees, the mortgage you have made out-of an approved bank. New Virtual assistant knows the newest monetary pressures experts deal with, such without having a number of the chances to generate wealth one almost every other People in the us has actually because they invested the period from the military.

Of a lot things enter whether your loan is acknowledged, exactly what your rate of interest would be and exactly how much currency your can be use. A decreased credit rating or even a bankruptcy proceeding or foreclosures inside the your earlier in the day aren’t obstacles of getting a great Va loan.

Minimum Credit rating getting Va Loan

There’s no minimum credit history so you can qualify for a beneficial Va financing. Financial institutions and you will home loan businesses that provide the money having Virtual assistant money, whether or not, possess credit history conditions.

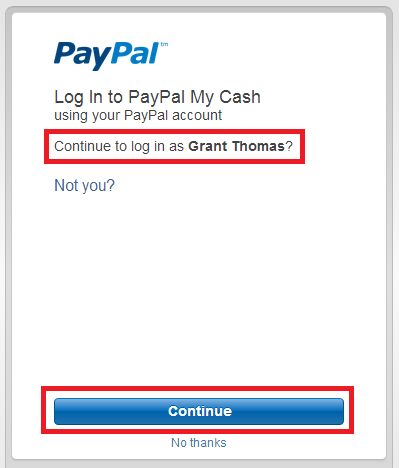

In general, you must have at the very least good 620 credit score to acquire an effective Va financing of very lenders. When your has actually an excellent 550 if not five hundred credit score, regardless if, you may still be able to find a loan provider to own a beneficial Virtual assistant loan. Understand that new Virtual assistant need approve the lender and you will will get nix you to definitely giving that loan to help you a debtor which have an effective suprisingly low get if for example the mortgage doesn’t meet the VA’s standards. The best Va mortgage loan providers to possess bad credit functions directly towards Va with the mortgage and you can making certain that it can not end up being a financial weight to you.

The latest Virtual assistant will simply be certain that a loan if you are not a card chance. With people Virtual assistant financing, your revenue and property play a part in delivering recognized and you may determining what kind of cash you might acquire. If your credit score is lower, that does not mean your present credit rating shall be inside an excellent shambles.

The brand new Virtual assistant necessitates that loan providers look closely at your bank account, for instance the past one year of your own credit payday loan Denver history and also make sure youre a suitable chance. There should be zero delinquent money for that period. Additional factors, together with money, debt and employment and need prior muster.

Keep in mind that the greater your credit rating, the better the pace and regards to your loan have a tendency to getting. Whenever you take time to replace your credit history, get it done.

Most other Flexible Va Loan Standards getting Pros

The brand new Virtual assistant would like to help set experts into their own house. Homeownership is just one of the greatest indicates to have People in the us who don’t have higher-spending services otherwise passed down money to construct wide range. Nevertheless the Va does not want experts to get rid of right up during the an excellent loans spiral and you can foreclosures, that it has some requirements to own veterans, armed forces professionals and you can thriving partners just who be eligible for financing. A few of the standards was versatile, most are perhaps not.

Credit score

The new Va doesn’t have minimum credit rating requirement, but credit history could be taken into account of the a loan provider. Very will require 620, however, you will find loans readily available for consumers which have all the way down fico scores.

Debt-to-Money Ratio

Debt-to-Money Proportion (DTI) is actually month-to-month personal debt payment amount as compared to disgusting monthly earnings. DTI tips how good you control your bills. Gross month-to-month earnings is actually money in advance of fees or other write-offs. Personal debt is borrowed money, along with auto loans, playing cards (balance try borrowed currency), other finance and credit. This new Virtual assistant demands a beneficial 41% DTI, regardless of if into the infrequent cases get enable it to be around 50% in the event that income or any other economic activities surpass criteria.

Được đóng lại.