Interest rates is actually a button difference between home security finance and you may HELOCs

HELOCs and household equity loans possess some parallels in that one another allows you to accessibility your home equity for a great type of aim. However they each other involve taking right out one minute home loan so you enjoys a few money. Beyond you to definitely, you will find several differences.

Full, an element of the differences when considering a house equity loan and you will an effective HELOC would be the ways home owners located their money, the difference when you look at the rates of interest together with cost selection. Let’s establish these secret variations in more detail.

Interest rates

For example, a property collateral mortgage will enjoys a fixed interest and you will a great HELOC enjoys a changeable otherwise adjustable interest rate.

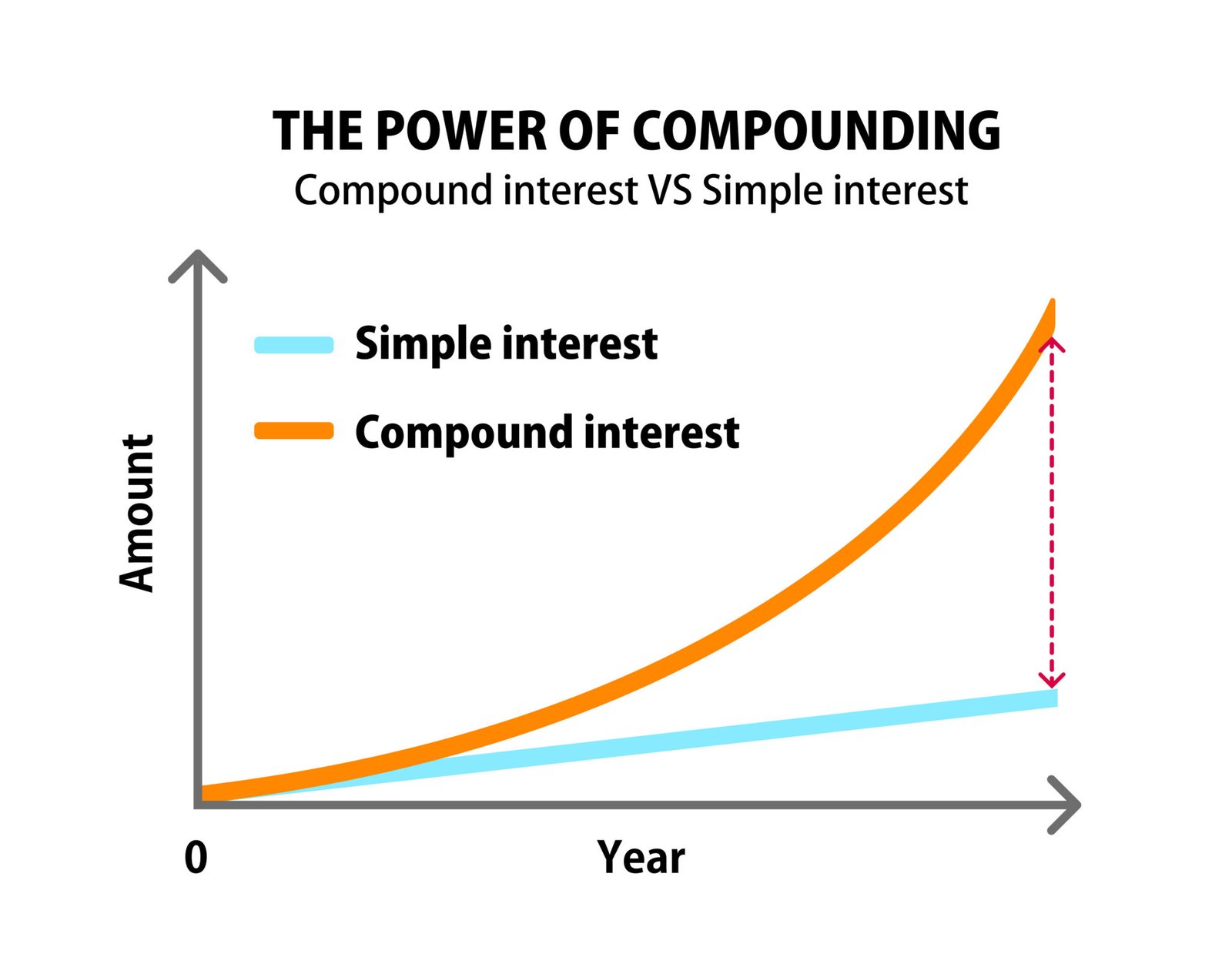

A fixed interest means that the rate of one’s loan continues to be the exact same on the whole period of the financing and you can does not fluctuate because of the discount. Although not, an adjustable rate of interest does fluctuate during the lifetime of the newest mortgage depending on the economy and its influences.

Interest levels to your domestic guarantee funds shall be fixed otherwise changeable. Whenever they to alter, they will are still repaired getting an occasion during the start of the loan prior to changing for the rest at the mercy of specific hats. It is distinctive from adjustable-price fund which could to evolve per month on field. But not, your house security loans supplied by Rocket Mortgage has fixed prices.

As a result when a citizen removes property security loan, their attention speed money be consistent every month, however when a resident uses a good HELOC, their attention price can potentially transform per month.

Month-to-month Mortgage payments

Monthly mortgage repayments may vary considerably anywhere between house equity finance and HELOCs for all reasons. Inside mark period for an effective HELOC, you are merely necessary to afford the focus. Which have property collateral loan, youre paying dominating and you may desire in the very start.

Outside of the structure becoming other, HELOCs constantly come with variable interest levels, meaning your own fee can alter monthly. Domestic guarantee finance often have fixed pricing, so that the payment will not changes.

Disbursement Of cash

One of the most significant differences when considering domestic collateral financing and you will HELOCs is the ways property owners found their money. For example, house collateral funds bring home owners entry to its borrowed loans for the a lump sum payment upfront. While doing so, HELOCs enable it to be residents to draw regarding the lent cash on an enthusiastic as-required foundation over the years prior to freezing from inside the cost several months.

Repayment Terminology

People who take out family security fund need to make monthly costs into the mortgage. Extent https://simplycashadvance.net/personal-loans-nv/ owed per month and also the installment period to the mortgage may vary with respect to the financing terms and therefore will likely be impacted by what kind of cash are borrowed during the a great provided rate of interest. However the full fee of harmony also appeal initiate right aside.

HELOC fees choice rather vary from the new times-to-day commission away from a home collateral mortgage. HELOC fees is comparable so you’re able to a credit card, definition a resident is acquire around a certain amount to have the life span of your own loan, bring an equilibrium monthly, and make lowest costs to the financing. Typically, HELOCs supply an effective mark period, whenever an effective homeowner’s monthly obligations might be simply for the attention of mortgage.

Following this appear a fees period. During this period, a citizen will make regular money of your own financing dominating having added interest up to its repaid. How much money a resident get approved getting with an effective HELOC depends on of several activities such as the home’s well worth, simply how much you borrowed, along with your credit history.

Được đóng lại.