Consumers Self-help guide to USDA Financing Credit score Standards

USDA financing credit rating standards are prepared by the lenders, perhaps not of the Leave out-of Farming by itself. See just what it needs in order to qualify.

Extremely lenders require an effective 620 minimum credit rating, yet, if your score drops less than one, you are nevertheless on games. The You.S. Institution regarding Agriculture (USDA) will not put a difficult minimum, for example loan providers can always accept you that have a lower life expectancy get.

Curious just how? We are going to falter the newest USDA credit score standards and you can that which you does to improve your odds of qualifying to possess a mortgage.

Just what credit score do you want to rating an effective USDA mortgage?

But we have found a secret: The USDA doesn’t set the absolute minimum credit rating, which means that lenders is also agree your that have less credit history if they’re convinced you might pay off the borrowed funds.

The objective of USDA fund is to try to make homeownership significantly more available, while the flexible borrowing from the bank guidelines try one way it reach that goal.

There is also no downpayment requisite. That makes these money an affordable path to homeownership for individuals who meet up with the earnings limitations and generally are to invest in in a being qualified area.

I really don’t meet up with the USDA credit score requirements, but have an abundance of savings. Must i nevertheless meet the requirements?

Lenders look at your credit rating to decide whether you’re a great creditworthy borrower. They appear to own things such as a decreased borrowing from the bank utilization proportion and you can a record of on the-day money.

Nonetheless they in addition things happen that cause the credit score to drop. Perchance you went through personal bankruptcy a few years ago, or you decrease behind toward debts because of a healthcare crisis. If the credit score was low, nevertheless has minimal bills and solid savings, they might qualify you even after a score under 620.

The new USDA cannot set the very least credit score, meaning that loan providers is accept your which have a lower life expectancy credit history if they are convinced you can pay back the loan.

Simply keep in mind that you can have continuously savings. You aren’t eligible for USDA for those who have good 20% deposit, based on program guidelines.

Possibly loan providers have a look at situations such as to the-date rent and utilities costs so you’re able to fill out the latest holes when the you really have a low get.

Not totally all loan providers will work with borrowers who’ve down credit ratings. That is why it is really worth applying having at least about three, as well as the one that have a tendency to works together lower-credit homeowners. In the event a lender doesn’t accept you instantly to have a beneficial USDA financing, they can render tips on how to replace your probability of bringing a loan a couple months down the road.

Extra USDA mortgage standards

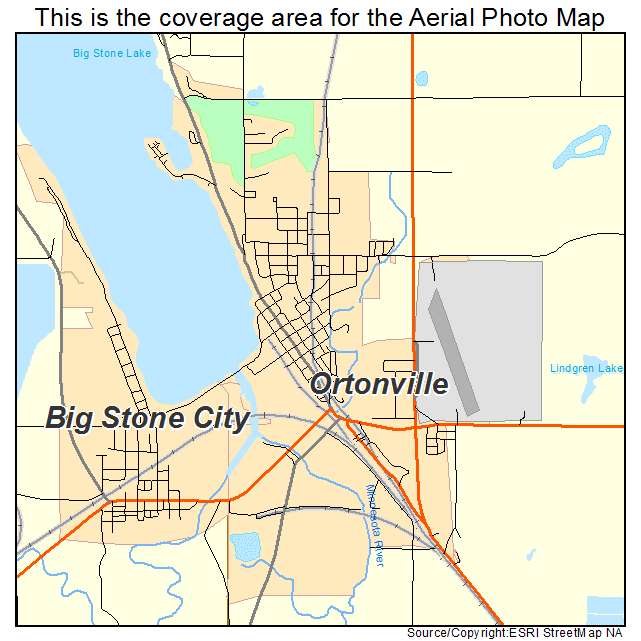

There are even limitations installment loan Charlotte toward brand of functions you could potentially loans. The house need to be in a being qualified rural otherwise residential district town, therefore have to be an individual-relatives residence — zero multifamily attributes allowed.

USDA financing individuals is subject to money constraints also. Full house money don’t surpass 115% of average domestic income of the city where you need it.

Eventually, USDA advice allow the financial to examine new automatic underwriting effect to find the debt-to-income ratio you’ll need for their transaction.

FHA loans need a great 580 credit history that have an effective step 3.5% down payment, and you may use gift money to cover that cost.

If you’re a seasoned or active-responsibility military servicemember, it is possible to qualify for an excellent Virtual assistant mortgage having an excellent 0% advance payment.

Just as in USDA loans, there’s no bodies-mandated lowest credit history for a beneficial Virtual assistant financing, so you may meet the requirements having a low rating. But some loan providers requires individuals for the absolute minimum 580 credit score.

Được đóng lại.