2nd Family Build Mortgage: Everything you need to Discover

For people who and your family features longed-for a spot to get off the fresh new active, non-avoid craft regarding daily life, you could begin dreaming off owning the next family otherwise vacation property. Otherwise, possibly you might be a trader trying to do a steady earnings load of the design a vacation family that may be leased aside during the the entire year.

Developing the ideal beachfront house, vast lake household, traditional cabin, or trendy barndominium takes more than just a dream it is going to need reputable investment.

The second domestic framework financing is the ideal choice for strengthening a vacation assets otherwise next family from inside the South Texas that suits your specific need. Find out how home structure funds performs, the loan acceptance processes, and just why Tx Gulf of mexico Lender is the best lending lover to have design your second home in your neighborhood.

The basics of Next Household Construction Funds

Design fund to have second homes is quick-identity financing choice that provides the credit to create out of the assets, with quite high rates of interest and you will a shorter repayment windows opposed for other old-fashioned mortgage types. This type of loan financing the expense on the building a good next household otherwise trips assets, that will include:

- To get belongings

- General specialist

- Architect and blueprints

- Laborers

- Construction material

- It permits

These types of finance range from conventional mortgage loans in several ways. Typically a possible household client lookups using their available a house choices for a first home after which starts the applying procedure having a loan provider.

Although not, which have second domestic build fund, potential individuals first must safer a creator, upcoming experience an https://cashadvancecompass.com/personal-loans-ms/long-beach/ acceptance procedure. Try to complete the particular building arrangements, an extensive design schedule, an in depth funds, and you may relevant monetary records.

When the recognized, the lender renders fee withdrawals (elizabeth.grams. draws) straight to brand new contractor when particular build milestones are found. This means all the funding happens individually with the framework therefore the house is going to be accomplished as close towards projected prevent date that one may.

In framework stage, individuals are just accountable for paying interest towards the finance pulled during the the construction financing. With a casing-simply financing, the debtor is in charge of make payment on financing entirely when build is performed or applying for a traditional home loan in order to safe permanent financial support into full amount borrowed.

There are some risks that come with developing a second household regarding crushed upwards. Before you apply having a casing financing, consider facts such as:

- Construction timelines

- Labor otherwise material shortages

- Newest rates

Climate occurrences, also provide chain disturbances, and you will work shortages may cause substantial delays inside design. Likewise, motion for the interest rates ought to be noticed before you start one minute home framework application for the loan.

Most of these items can rather affect the structure of the household, along with your capability to pay off the borrowed funds.

What to anticipate Inside Loan Approval Procedure

If you opt to work with Texas Gulf coast of florida Lender to have next household framework financing, we shall begin the method having an initial investigations to determine your current monetary updates and capacity to repay the borrowed funds. Funds having 2nd land angle a top exposure for lenders, and so the approval processes is a bit more descriptive and you can strict than a basic home loan software.

We ask that consumers fulfill numerous financial standards to help you qualify for a homes mortgage, and additionally with its enterprise agreements accepted in advance. About initial investigations to determine for folks who qualify, we are going to remark next information:

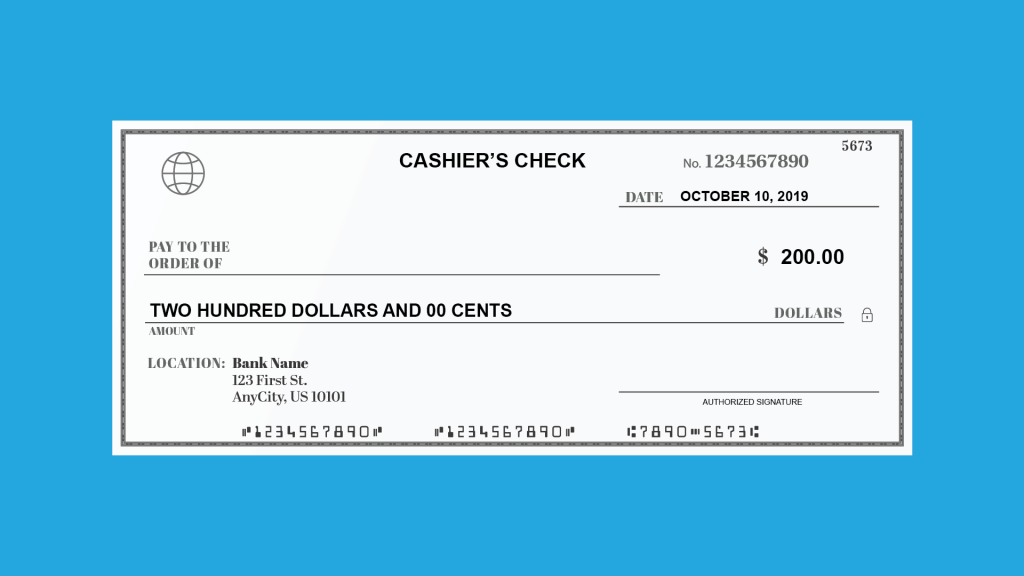

An excellent credit history is preferred for next domestic design financing individuals. Along with, we will find out if you could cover the desired deposit on structure financing. To examine the certification, we shall consult next financial documentation:

On top of that, a drive-because of the inspection is also area of the next house construction mortgage way to verify there are not any other advancements being generated for the the home. When the there are not any label otherwise valuation factors, the typical mortgage recognition process away from app so you’re able to money are ranging from 31 so you can forty-five weeks with Colorado Gulf of mexico Bank.

Once acknowledged, your own builder begins choosing pulls on the structure financing so you can pay money for each of the other degree regarding design.

As to why Like You for the Second Home Build Loan?

Your ideal vacation oasis can be possible towards assist away from the second household design financing due to Tx Gulf Financial. With over 100 years of feel, we’re a robust, legitimate, economically safer local lender that is committed to building a lot of time-lasting relationship with the subscribers whilst providing exceptional solution.

The second house framework money are made to fulfill your specific demands. We out-of experienced loan officials helps you discover your available capital alternatives, upcoming get you started to the loan application process.

Just like the a location bank, i worthy of the capability to hook and help consumers with every action of your own mortgage analysis and app processes. You might generally consult with a lender the same go out so you can talk about the second home structure needs and you can investment needs.

On the other hand, the distance into the Gulf Coastline offers we more understanding toward threats and you will advantages that include creating one minute family here, such weather occurrences, floodplain areas, and you will environmental issues that you will affect the security and value from your next family.

Do you want first off building the following family you always longed for? Tx Gulf Lender makes it possible to come across a moment home construction mortgage that is true for your requirements.

Được đóng lại.